Matthew Griffith, CFA, Senior Research Analyst

If I were a business journalist, this is the type of market environment that would make me the most excited to come to work each day. Just four weeks ago, a headline from Reuters read “Rising rents, healthcare costs boost underlying U.S. inflation.”1 I am not sure if any of our clients read the article — I know I did not. Sure, the headline gets the job done, but it is likely that, no matter how good the headline, the dull subject matter is not going to elicit much excitement from the average reader (or likely even from the author). Fast forward to this week, and Reuters’ headlines now read “Dow futures point to third day of losses after Monday’s dive,”2 “Wall St. plunges, S&P 500 erases 2018’s gains,”3 and “Investors burned as bets on low market volatility implode.”4 Those three articles probably were much more fun to write while also driving more readership, which, at the end of the day, is likely how the average business news reporter is evaluated.

Consuming these types of articles does not help to make us better investors. While the headlines are much more visceral, they also capitalize on the reader’s fears about investing and encourage poor behavior. First, and most importantly, none of these articles are written from the perspective of the investor. The authors do not have investors’ goals or financial plan in mind when writing, and when constructing an investment portfolio, those are the only outcomes that matter. Imagine the following headline, which could also have appeared this week and would be just as true, yet much less exciting: “Area retired couple with 70% allocation to fixed income feels no impact on their lifestyle from recent market declines.” Or, for a younger investors, “6% drop from all-time stock market highs presents great buying opportunity for 27-year old with 38 years remaining in her career.” When investing, context matters. For the large majority of investors who invest within the context of a sound financial plan, the movements of the market over the past few days should have little to no impact on their ability to achieve their long-term financial goals.

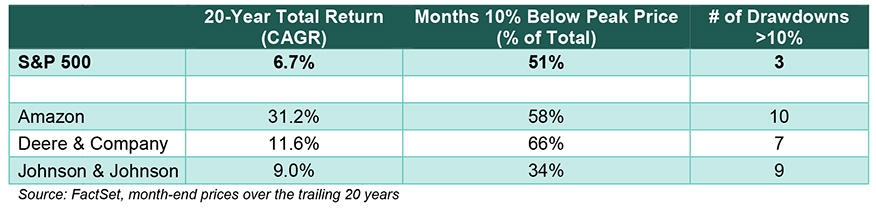

Another common theme found in the media over the past few days is that ‘volatility’ has again returned to the financial markets. The word volatility has a largely negative connotation. It is defined as the “liability to change rapidly and unpredictably, especially for the worse.”5 We rarely hear this word associated with positive investment performance, and volatility is even used as a measurement of risk in almost all academic research on investing. In fact, for investors with long time horizons, volatility should be synonymous with opportunity rather than risk. D.A. Davidson’s Individual Investor Group Research team is focused on identifying high-quality companies that will help our individual investor clients achieve their financial goals over periods measuring in years. We have found that many of these high-quality companies often drawdown from peak levels. The table below looks at some drawdown statistics for the S&P 500, as well as three large-cap stocks that have outperformed the S&P 500 over the past 20 years.

During 51% of the months over that 20-year period, the S&P 500 was 10% below its peak price, and three times during that time period it reached an all-time high and subsequently declined by more than 10%. For these selected individual stocks, the statistics are generally much less favorable, with more frequent drawdowns below all-time highs and more time spent below peak prices. What these statistics show is that even high-quality stocks that deliver above-market returns over time have periods of difficult performance. When given the opportunity to acquire shares of high-quality companies at a discount, it is often during times of market stress and uncertainty.

Asset allocation is the most powerful way to balance the risk and return of an investment portfolio, and it is important for investors to work with their advisor to ensure that their asset allocation is appropriate given their risk tolerance. Equity exposure that is too large relative to a client’s risk tolerance can lead to unfavorable outcomes. But once this asset allocation is set at an appropriate level, investors with allocations to equities should welcome volatility and seize the opportunity to buy equities at a discount when the market is focused on short-term performance.

For more information, feel free to reach out to a D.A. Davidson financial advisor.

1 https://www.reuters.com/article/us-usa-economy/rising-rents-healthcare-costs-boost-underlying-u-s-inflation-idUSKBN1F11QD

2 https://www.reuters.com/article/usa-stocks/us-stocks-dow-futures-point-to-third-day-of-losses-after-mondays-dive-idUSL4N1PW4F8

3 https://www.reuters.com/article/us-usa-stocks/wall-street-plunges-sp-500-erases-2018s-gains-idUSKBN1FP1OR

4 https://www.reuters.com/article/us-global-markets-volatility/explainer-investors-burned-as-bets-on-low-market-volatility-implode-idUSKBN1FQ2GL

5 https://www.google.com/search?q=volatility+definition&sourceid=ie7&rls=com.microsoft:en-US:IE-Address&ie=&oe=

Information contained herein has been obtained by sources we consider reliable, but is not guaranteed and we are not soliciting any action based upon it. Any opinions expressed are based on our interpretation of the data available to us at the time of the original publication of the report. These opinions are subject to change at any time without notice. Investors must bear in mind that inherent in investments are the risks of fluctuating prices and the uncertainties of dividends, rates of return, and yield. Investors should also remember that past performance is not necessarily an indicator of future performance and D.A. Davidson & Co. makes no guarantee, expressed or implied to future performance. Investors should consult their financial and/or tax advisor before implementing any investment plan.