If you see Social Security or OASDI (Old-Age, Survivors, and Disability Insurance) deducted from your paycheck, you may be wondering how the program works and how soon you can collect benefits. Here’s what to know.

Am I eligible?

If you paid into Social Security for at least 40 quarters or 10 years, you can begin to collect your benefits as soon as age 62.* If you did not pay into Social Security for 10 years, but your spouse did, then you can start spousal benefits as soon as you turn 62.* You can collect before age 62 in certain circumstances such as disability or if you are a widow with a minor child.

*If you are still working and collecting Social Security at the same time, your benefits may be temporarily reduced (see 7 Social Security Strategies and Lesser Known Facts for more information). If you or your spouse worked at a job where you did not pay into Social Security, such as a government job, your benefits may be reduced (possibly all the way to zero because of the Government Pension Offset and/or Windfall Elimination Provision).

How much will I receive?

View your Social Security statement online at ssa.gov to retrieve an estimate of your benefits.

When should I start my application? If you retire at 60, you still must wait until at least age 62 to start your application. Even though you can start receiving your Social Security benefits at 62, you should consider waiting as long as you feel comfortable because your benefit will grow 8% each year you delay. By delaying, you are also increasing any potential widow benefit for your spouse because the widow can step up to 100% of whatever you were receiving (assuming your benefit is higher than their own).

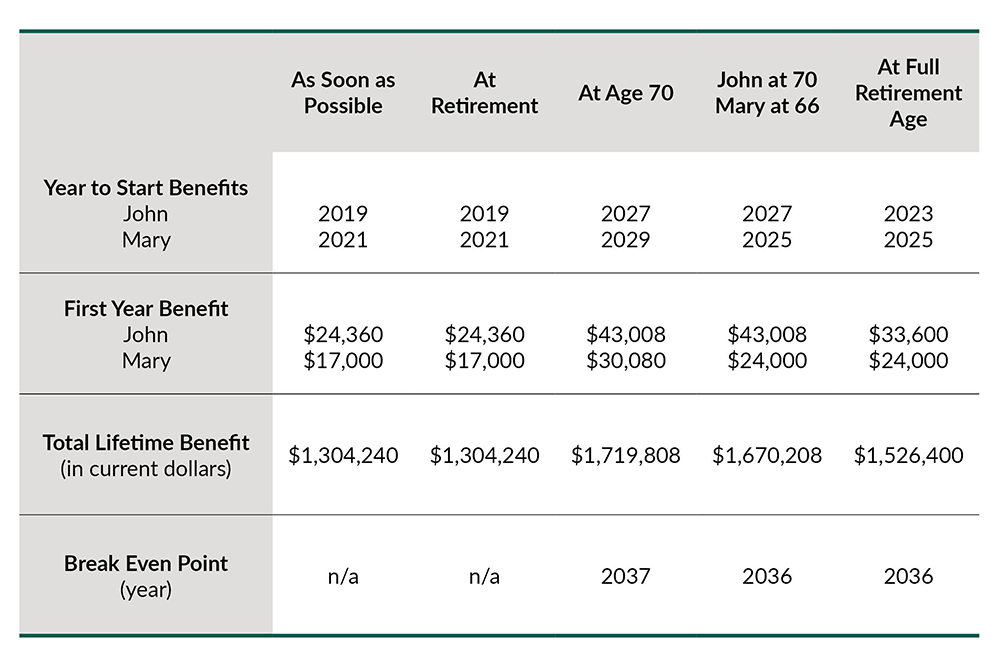

Below is a chart demonstrating the differences of taking Social Security benefits at full retirement age (66 or 67 depending on your birth year) versus earlier or later:

It is important to remember that everyone’s situation is unique, and whatever path you choose depends on your specific goals and circumstances. For more information, or to get started on your financial journey, contact a D.A. Davidson financial professional or visit ssa.gov.

This material is being provided for educational and informational purposes only and is a general discussion of certain Social Security provisions, based on our understanding of Social Security rules at the time of publication. The rules governing Social Security are numerous and complex, and we strongly encourage you to contact the Social Security Administration for guidance on your specific situation. D.A. Davidson & Co. is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. Information contained herein has been obtained by sources we consider reliable but is not guaranteed and we are not soliciting any action based upon it. Any opinions expressed are based on our interpretation of the data available to us at the time of the original article. These opinions are subject to change at any time without notice. Copyright D.A. Davidson & Co., 2024. All rights reserved. Member FINRA and SIPC.