2-Minute Takeaway

Navigating the market during an election year can be daunting for many investors. Concerns often arise from uncertainties about the incoming administration, international relations, and the potential for market fluctuations. Despite the possibility of volatility, it is crucial to maintain focus on your long-term financial goals. The heightened emotions of campaign season can easily sway decisions, but allowing short-term anxieties to dictate your investment strategy may result in missing out on the market’s best days. History shows that, regardless of which party wins in November, the market has demonstrated resilience over time.

Market Overview

Short-term returns in the market can be influenced by media headlines, pop culture, and in this case, the election. However, long-term returns are affected by fundamental elements of the stock market, such as inflation, Federal Reserve policy, earnings, and economic strength. These fundamental aspects are not easily affected and can take a long time to change. Regardless, businesses want to be successful, no matter who is in office. Policy changes will not destroy businesses overnight, so don’t let it destroy your confidence in the stock market.

Historic Data

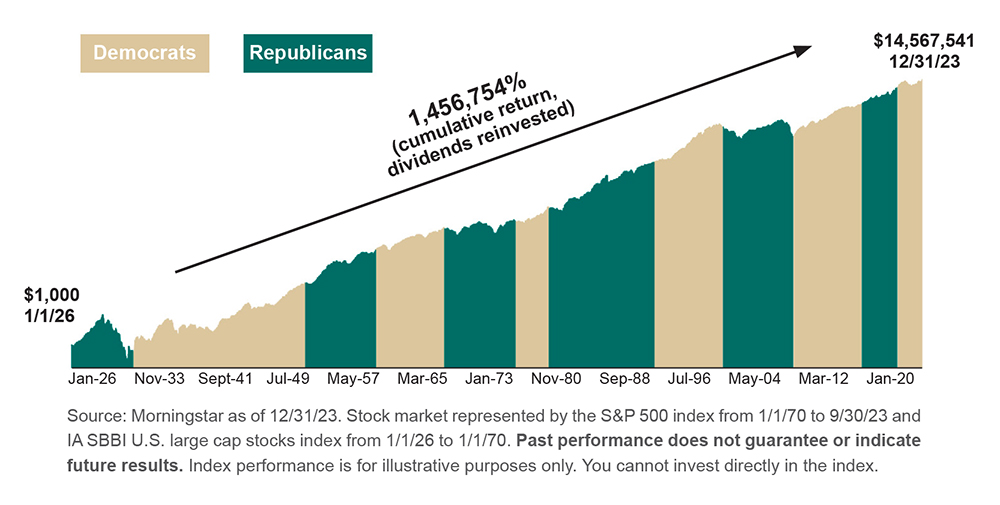

The graph below references the S&P 500 index, which is a commonly held representation of the U.S. stock market. The market has shown great resilience to the political climate over the years, which is why it is essential that you keep your long-term goals and strategies in mind during election years.

Time in the Market vs. Timing the Market

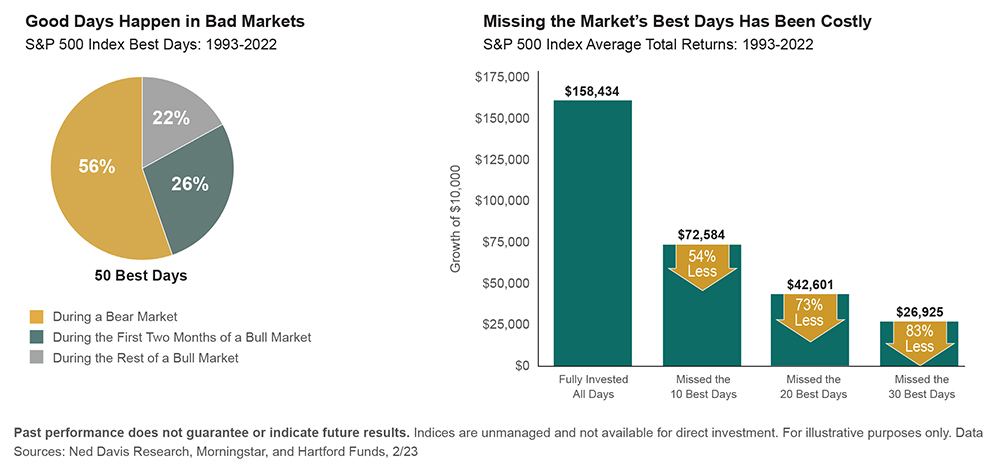

You may have heard the famous saying “Buy low, sell high” when individuals refer to investing. While it sounds like a no-brainer, it can be a very risky, short-term strategy. This investment strategy leads to less time in the market and can diminish your returns greatly. Instead, investors that stay in the market through the low and high periods see a much greater return further down the road. Trying to time the markets or withholding out of concern can lead to many missed opportunities. The graph below shows the effect missing the best days in the market has on your overall returns. As you can see, by missing the 10 best days over the last 30 years, your returns would be 54% less, and 83% less if you miss the 30 best days.

Conclusion

Sticking with your long-term investment plan based on your individual goals is the best course of action. Whether that strategy is to stay fully invested throughout the year or to consistently contribute to your portfolio, the bottom line is that you should avoid trying to time the market around politics. The key to achieving your long-term goals is to avoid the short-term noise.

This material is being provided for educational and informational purposes only. D.A. Davidson & Co. is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. Information contained herein has been obtained by sources we consider reliable but is not guaranteed and we are not soliciting any action based upon it. Any opinions expressed are based on our interpretation of the data available to us at the time of the original article. These opinions are subject to change at any time without notice. Copyright D.A. Davidson & Co., 2024. All rights reserved. Member FINRA and SIPC.